CS in hurricane, but Gottstein only lowers compensation a little

- By sennenqshop/li>

- 665

- 10/05/2022

Credit Suisse is a tottering giant that could sweep Switzerland with it. Leverage exposure, a number of total risk, exploded from CHF 800 billion to CHF 875 billion.

What's going on there? The number 2 urgently needs to be made storm-proof after billion-dollar scandals. But instead, risk sizes are shooting up.

Are the Masters of the Universe doing their job from Paradeplatz? Or are they on a break, having fun with Porsche magazines and property pictures?

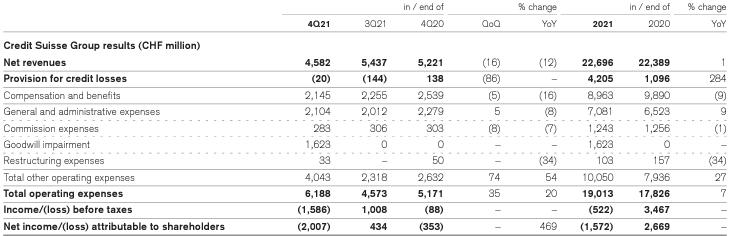

In 2021, CS “achieved” a loss of 1.6 billion with Thomas Gottstein at the top. In a year in which UBS achieved a new record profit.

Under Gottstein, the CS fell deeper than ever.

Taking profit under his leadership in 2020, which was $2.7 billion, Gottstein has accounted for a $4.3 billion deterioration over 12 months. Delta, Gottstein style.

The journey led straight to the abyss. And what do the chief helmsman, his management, the board of directors do as conscience and watchdog? Radically turn the tide, brutally rehabilitate?

Oh no. The heroes of Swiss Banking watch more or less casually from their stools as the bank goes to the dogs.

The numbers show that. In the fourth quarter, the rich customers fled and the business collapsed, especially in the supposed flagship area, private banking.

One thing that particularly catches the eye is what banking has been about for centuries: one's own earnings. The wages and bonuses of the whole CS crew amounted to 9 billion in 2021, for which CS reported earlier this morning.

Certainly worlds less than in the comparison year 2020, right? Not really. At that time, the position in the income statement was 9.9 billion.

We're talking about a decline of 9 percent.

Mini.

Then CS slammed into the wall, rubbed billions on the leg with spectacular scandals, including criminally relevant ones, and its shares tested new lows.

And what is your top management doing? It cuts wages and bonuses by not even a tenth. It's hard to believe: a financial tanker, a leak struck, caught in a storm, hopelessly damaged, and what happens?

As good as nothing.

It gets even better.

The second major expense item in the income statement - emphasis on the latter - includes IT, rent, marketing - you name it.

You can always brake immediately if you get caught. So sure a sharp drop, right? nope None, also here.

Spending didn't go down as expected - it went up. From 6.5 to 7.1 billion, up 9 percent. Exactly as many plus percentages as corrected above for compensation for staff.

Business is simple at the end of the day. If it works, it invests and earns. If it rattles, you need dismantling and a fresh start.

The CS with Gottstein and his people now shows that they throw the laws of the market and the economy overboard at their bank. You carry on more or less as if nothing had happened.

The main thing is that the ruble rolls – not least for yourself.

Of course, that doesn't last forever. The CS has reached the point where it has to sell its last silverware. She recently sold her magnificent residence in Basel, previously she threw almost everything on the market that flushed cash into the register.

What remains is the seat from the time of Alfred Escher. The rest: Adios.

The bench is on the hull. Your plan to get up to speed with private banking is not working. In 2021, CS earned 23 percent less in International Wealth Management "without taking significant positions into account".

Here too: business is collapsing, wages and other things continue to be proud. Minus 11 percent is the balance sheet for the income generated, i.e. the turnover. Expenditure, on the other hand, only fell homeopathically, by a measly 1 percent.

It's not about a sausage shop. The CS is relevant for the country and its citizens, it must be radically put on a new footing. Today's troops at the top are not able to do that.

The risk is great for CS to finally lose touch and become a kind of zombie bank. She lives on the substance, her captains don't know what to do.

We'll always have Switzerland, they might say. The Swiss Universal Bank, SUB, runs like clockwork, right? Neither. From October to December, the richest among CS customers ran away.

“Net cash outflows of CHF 1.7 billion were driven by net cash outflows of CHF 1.8 billion in Private Clients, primarily as a result of individual cases in the Ultra High Net Worth (UHNW) and High Net Worth (HNW) client segments ) and the usual seasonal decline in the fourth quarter,” the bank said today.

All lamps flash bright red. And on the bridge they knock a Jass.